The rise of indian private port

- Deepak Thacker

- Apr 13, 2021

- 2 min read

Karan Adani, chief executive officer of Adani Ports and Special Economic Zone (APSEZ) and scion to the Adani group, informed stock analysts on an earnings call that his flagship port—Mundra, in the Gulf of Kutch—had become the busiest port in the country.

After nipping at the heels of its closest competitor for container traffic, JNPT (Jawaharlal Nehru Port Trust) at Navi Mumbai, for the last few years, Mundra finally pulled ahead in the first quarter of FY21, staging a faster recovery from the covid slump than the central government-controlled JNPT could.

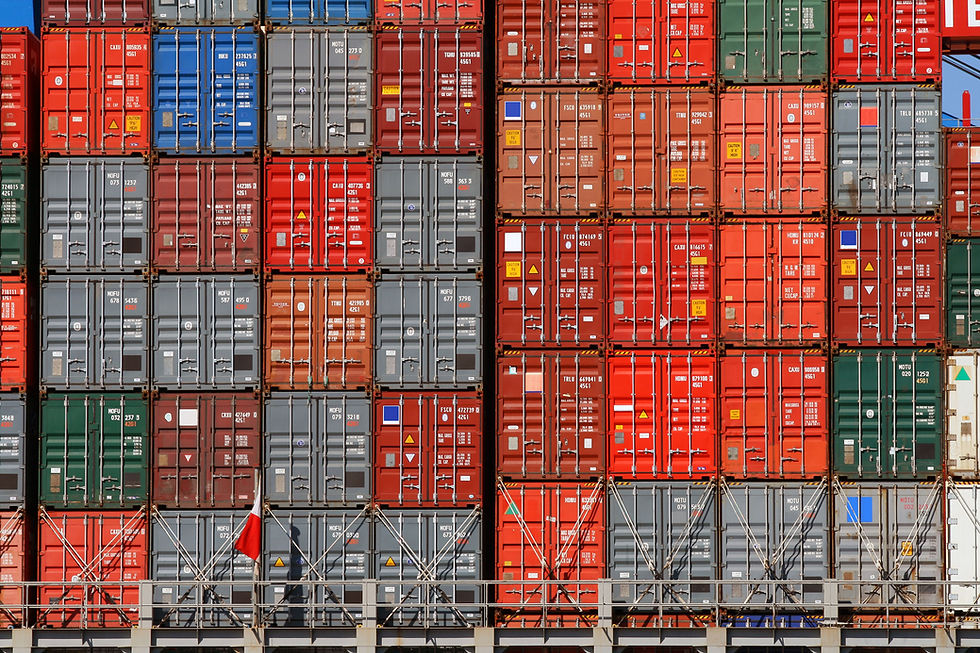

Since then, Mundra has repeated this feat every subsequent month, consistently widening the gap in container volumes between itself and JNPT. At the end of FY21, 7.22 million TEUs (twenty-foot equivalent units, a measure of container cargo capacity) had passed through Mundra, 16% higher than the previous year. In contrast, JNPT handled 4.68 million TEUs, a 7% year-on-year decline.

Adani’s Mundra port is the starkest example of a silent shift in cargo traffic growth from government-run to private ports. This rebalancing comes at a crucial moment: India has announced a slew of production-linked incentive (PLI) schemes which are expected to give a boost to exports as well as the import of intermediate goods.

The big-ticket goal of doubling India’s gross domestic product (GDP) is also not possible without a significant ramp-up in exports. Thus, if things go according to plan, private ports are uniquely placed to reap a windfall. And one entity stands to benefit more than anyone else: the Adani Group.

India’s port ecosystem is broadly divided into 12 major ports (controlled by the central government via the ministry of ports, shipping, and waterways), a handful that are run as public-private partnerships, and countless minor ports, owned privately or by state governments, which dot the country’s 7,500-km long coastline. It is in these smaller, nimbler minor ports that much of the action lies. And the Adani Group has managed—in the span of just a few years—to corner nearly half of India’s minor ports capacity.

The 12 major ports together handle about 55% of India’s cargo every year. However, incremental traffic growth at private ports is happening twice as fast as at these traditional strongholds. Abhishek Nigam, associate director at India Ratings and Research, estimates that over the last five years, volume growth at major ports has been at 0.6 times of real GDP while private ports have grown at 1.3-1.4 times of GDP. He has forecast an 8% y-on-y growth rate in cargo volumes in FY22, led chiefly by private ports.

_edited.png)

Comments